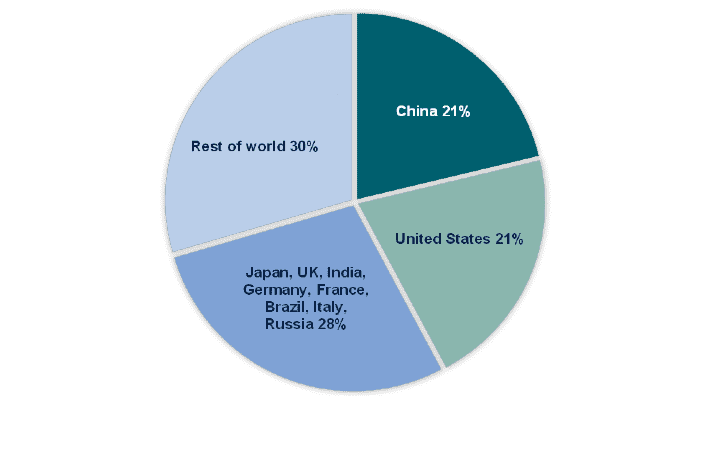

Just 10 countries contain 70 per cent ($141.5tn) of all global commercial and residential value (totalling $200tn). China and the US together make up 42 per cent ($84.8tn) of global property value alone.

China is home to more of the world real estate market assets (by value) than any other country at $42.7tn or 21 per cent of global real estate value, just ahead of the US at $42.1tn.

Japan, the UK, India, Germany, France, Brazil, Italy and Russia round off the top 10, between them accounting for 28 per cent, or $56.8tn, of the global real estate asset total.

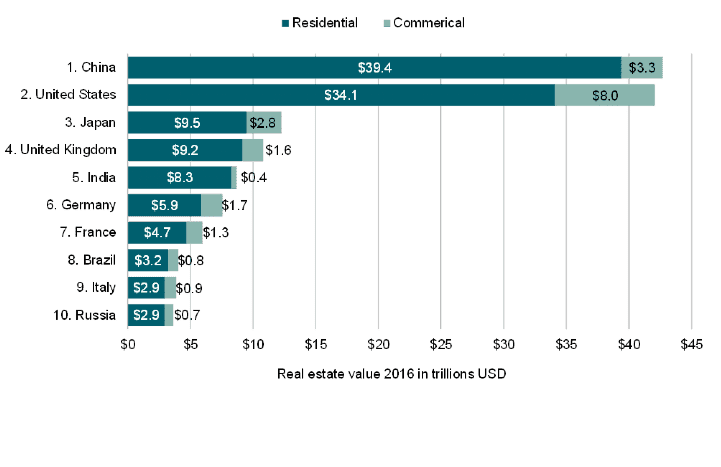

We have estimated total residential and commercial property worldwide to be worth just over US $200tn (US$200,000,000,000,000). The vast majority of this is residential, accounting for 84 per cent, or $168.5tn.

TOP 10 COUNTRIES BY RESIDENTIAL AND COMMERCIAL REAL ESTATE VALUE (2016)

DISTRIBUTION OF GLOBAL RESIDENTIAL AND COMMERCIAL REAL ESTATE VALUE (2016)

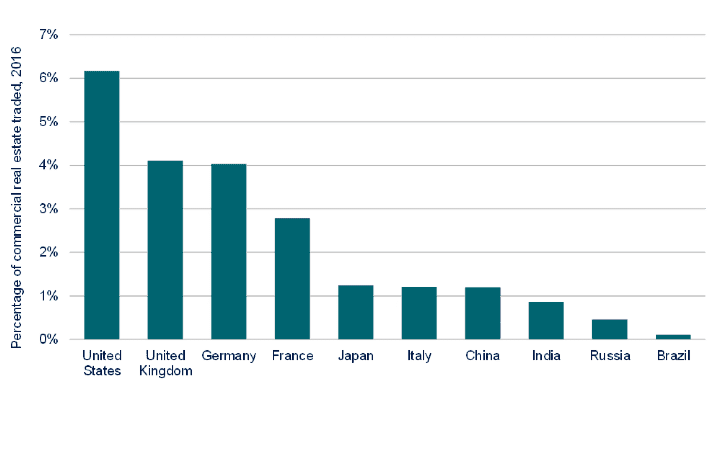

HOW DOES THIS COMPARE TO VOLUMES TRADED?

The most valuable national markets are not necessarily the most often traded. Market strength and liquidity make some markets more investible. Mature, transparent markets are more likely to attract cross-border investors, driving volumes.

Looking at big ticket deals in commercial real estate only (excluding development sites), the mature US, UK and German markets are among the most traded. They saw between 4 per cent and 6 per cent of all stock turnover by value in 2016.

Although large, China’s market saw only 1.2 per cent of its stock traded last year. The same figure was just 0.1 per cent in Brazil and 0.5 per cent in Russia, reflecting weak economic conditions and little cross border investment in those countries.

PERCENTAGE OF COMMERCIAL REAL ESTATE TRADED (2016)

Source: Savills World Research using RCA